Request a personalized quotation for our Shariah advisory, analytics, and academy services.

Registered Shariah Adviser

Registered Shariah Adviser

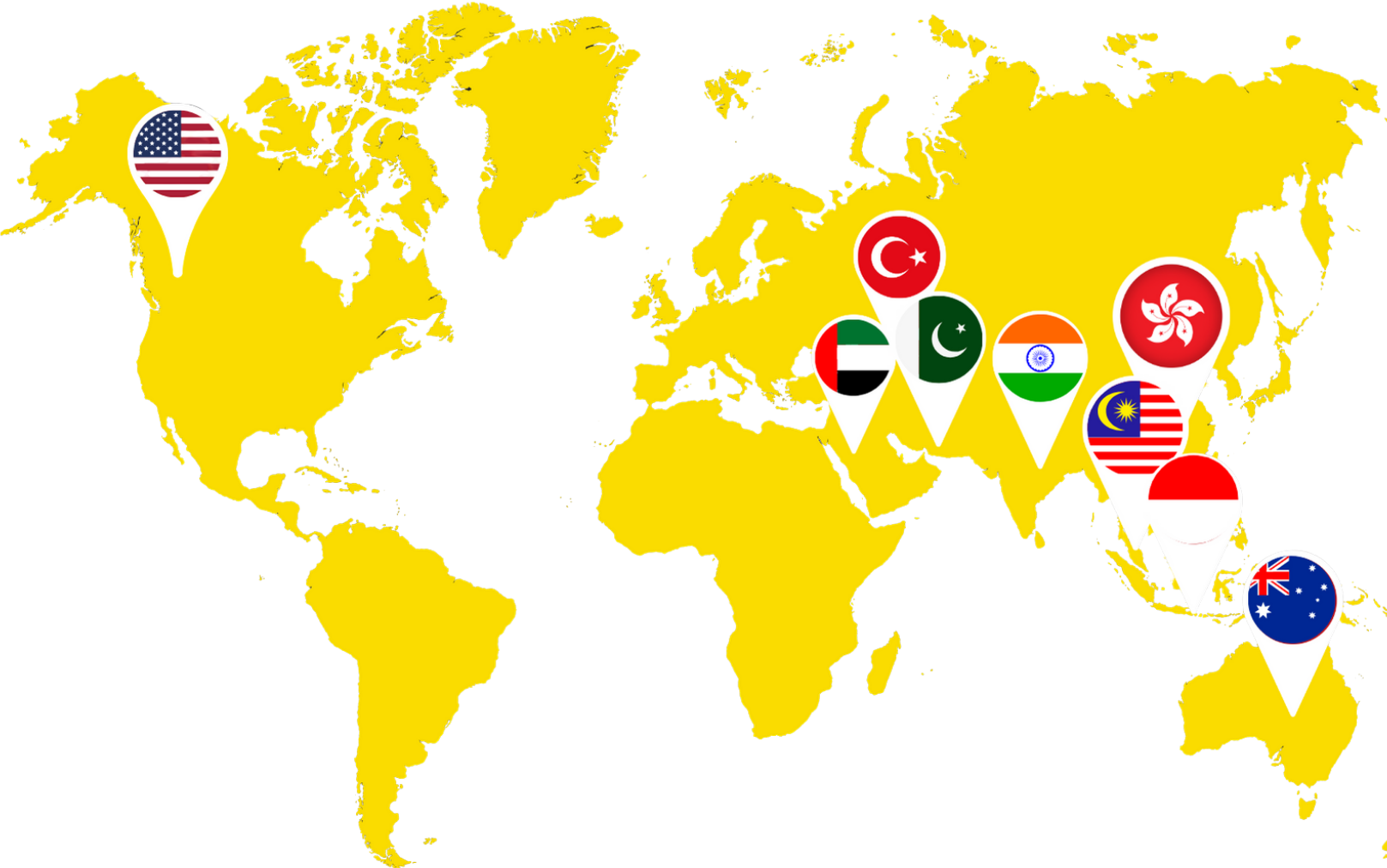

Network & Affiliations

Comprehensive Shariah advisory services including product structuring, review, audit, certification, and institutional Zakat services.

Advanced analytics and digital solutions for Islamic finance, providing Shariah status verification and payment gateway services.

Comprehensive training programs and certification services to build Shariah compliance capabilities within your organization.

Self-service tools and personal advisory services for individuals seeking Shariah compliance solutions.

i.destinasi

Shariah Advisory on Financing Product Offered Using Tawarruq Contract

AQIQAHCENTRE.COM

Shariah Advisory on Qurban Mecca Product

Halogen

Shariah Advisory for Halogen Shariah Enhanced Income Fund & MYR Liquid Fund

Lyndung

Shariah Advisory for Community Medical Bill Sharing Program

Luno

Shariah Advisory for Solana (SOL) and Cardano (ADA) Staking Services

Petrogroup

Shariah Advisory on Financing Product by Petrogroup Sdn Bhd

MuslimBit Exchange

Shariah Advisory Consultancy Services for MuslimBit Exchange

Saraf

Shariah Advisory Consultancy Services for Crypto Shariah Screening

YFLife

Shariah Advisory Consultancy Services for Insurance Product

iSaham

ESG + Maqasid

Shariah Screener.com

Shariah Screener for Global Stocks

Elzar Shariah Solutions & Advisory

Shariah Screening on Global Stocks

MyCARE

Crypto Donation System & Payment Gateway

PPZ MAIWP

Crypto Zakat System & Payment Gateway

Lembaga Zakat Selangor

Crypto Zakat System & Payment Gateway

Tekun Nasional

Speaker for 'Bengkel Pengurusan Mesyuarat Jawatankuasa Syariah'

WazzaRed

Training on 'Islamic Securities Screening & Compliance'

PhillipCapital

Training on 'Islamic Securities Screening & Compliance'

RHB

Training on 'Shariah Screening & Compliance for Cryptocurrency'

OCBC Al-Amin

Training on 'Shariah Screening & Compliance for Cryptocurrencies'

Modern Wealth Academy

Shariah Advisory and Review for Shariah-Compliant Crypto Trading Module

Whether you are a fresh graduate with your first job or a seasoned employee, many of us plan to buy a house, own a new car, or apply for financing. In this process, one crucial concept you need to understand is the Debt Service Ratio (DSR).Understanding DSR is the first step — and one that should not be overlooked — as it is the first thing financial institutions such as banks assess. In reality, many financing applications are rejected not due to lack of income, but because the borrower's debt obligations exceed their financial capacity. DSR is not just a number — it is a key indicator of whether your financing will be approved.

Read More

The rise of cryptocurrency has sparked numerous innovations in the digital finance world, including staking, a key method for earning passive income in blockchain ecosystems. Staking allows crypto asset holders to lock their assets to support network operations, such as transaction validation, in exchange for rewards. However, for Muslims in Malaysia, a critical question arises: does staking comply with Shariah principles? This article explains what staking is, how it works, and analyzes its halal status by referencing Shariah-compliant contracts.

Read More

The rapid advancement of technology today—particularly in the realm of digital currencies such as cryptocurrency—has sparked growing interest and debate within the Muslim community, especially regarding the halal or haram status of its use. Beyond major cryptocurrencies like Bitcoin and Ethereum, meme coins have also emerged—speculative tokens that have captured the attention of many crypto enthusiasts. The rise of meme coins often fuels discussions about their Shariah compliance, as they are frequently associated with speculation rather than real economic value.The discussion around cryptocurrency is not limited to its use as a trading tool, but also extends to its role as a long-term investment asset—for example, Bitcoin, which is often referred to as “digital gold.” As the adoption of cryptocurrency continues to expand, particularly among Muslims, the question of its permissibility under Islamic principles becomes increasingly important to ensure alignment with Shariah values.

Read More

Bangi, 9 December 2025: Sharlife Sdn. Bhd. recently paid an official visit to Yayasan Tadabbur for a strategic meeting characterized by professionalism and a spirit of collaboration. The Sharlife delegation was led by our Chief Executive Officer, Mr. Mohamad Zulhaikal Mat Zukri, alongside Mr. Adnin and Ms. Aqilah. The visit focused on exploring strategic collaboration between the two organizations, particularly in empowering the infaq and welfare ecosystem through Islamic fintech solutions. Sharlife reaffirmed its commitment to contributing expertise and digital solutions, including enabling infaq channels via digital assets, aligned with current needs and the evolving Shariah-compliant financial landscape. As a symbol of mutual commitment, the session concluded with the signing of a Memorandum of Understanding (MoU) between Sharlife Sdn. Bhd. and Yayasan Tadabbur. This MoU serves as the foundation for a long-term partnership aimed at supporting sustainable programs in dakwah, Quranic education, and welfare initiatives led by Yayasan Tadabbur. Sharlife Advisory looks forward to a fruitful and enduring collaboration, with the shared goal of creating meaningful impact for the community and the wider ummah.

Read More

At Sharlife, we are proud to lead conversations at the forefront of Islamic finance innovation. Our CEO, Mohamad Zulhaikal Mat Zukri, recently spoke at #LIDAC2025 organized by Luno on the pivotal topic, "Defining Compliance Through a Shariah Lens." This platform allowed Sharlife to reinforce our unwavering commitment to Shariah compliance where governance, transparency, and rigorous advisory standards are essential. We believe Shariah compliance is not simply a certification but a continuous journey demanding integrity and expert oversight. As trusted Shariah advisors, Sharlife is dedicated to empowering the global Islamic finance ecosystem with clear, credible, and practical guidance on digital assets and beyond. We encourage collaboration and innovation rooted in Shariah principles, ensuring ethical standards that protect and grow value for all stakeholders worldwide. A heartfelt thank you to Luno for organizing this impactful forum and for their commitment to advancing Islamic finance globally. Together, let us define the future of Shariah-compliant financial solutions.

Read More

We are proud to have conducted a tailored training session for OCBC Al-Amin on the topic: Stocks and Crypto Screening from a Shariah Perspective. As digital assets and Islamic investing continue to evolve, it is essential for financial professionals to remain informed and compliant. This two-part programme was designed to strengthen participants understanding and practical application of Shariah screening methodologies across both stocks and cryptocurrencies. Key learning outcomes included: Understanding the fundamentals and landscape of stocks and crypto Identifying Shariah issues and global fatwa positions Applying Shariah screening methods to evaluate financial assets Conducting legitimacy analysis on crypto projects Hands-on practice with crypto wallets and basic transactions From theoretical principles to practical case studies, our goal was to equip the OCBC Al-Amin team with the knowledge and tools to analyze and navigate the digital investment world all through a Shariah-compliant lens.

Read More